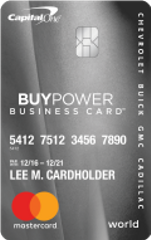

Slowly without much effort on my part, I have been accumulating a respectable rebate. A few times a year, Buy Power will offer special promotions to help earn even more rewards. I plan to buy a new car, so I have been racking up 5% rewards on all my purchases that I can use towards a new car. Lately, I have been using my Capital One GM Buy Power Card. I come from the Midwest, so many days can simply be classified as brrrrr! I will plan out new restaurants to try, preferably with outdoor seating to enjoy the warm summer weather. My favorite quarter is the summer quarter, where for the last few years, it has been 5% cash back on dining. For higher cash back rewards, typically I plan my purchases around my Discover it Card. I use my Citi Double Cash Card as my main go-to card for all purchases that do not fall into particular categories where I can not earn more than 2% cash back. I prefer cash back credit cards for simplicity. I consider myself a Plain Jane when it comes to credit card rewards.

And a year ago, my family and I flew to Belize for a vacation and the only money we spent out of pocket for our flights was for fees. Between card spending and flights I earn valuable rewards including A-list status which means I'm always in the first boarding group so I can choose a more comfortable seat. I selected this credit card because I fly Southwest frequently for work and find their rewards program to be the most flexible of any airline I've flown. I’ve been able to maintain that benefit now for more than two years.

#Capital one powercard reviews free

I have both the business and personal Southwest Rapid Rewards credit cards, and I love them! Initially, I used sign-up bonuses to earn a free Companion Pass, allowing someone to fly with me at no cost. Gerri Detweiler - Education Director for Nav The cashback credit card landscape is always changing therefore, it would behoove you to do the research to ensure that you’re not leaving any money on the table. Along those same lines, you should think about your purchasing habits and then sign up for and get the credit cards that will net you the most cash back. For example, if you make a lot of purchases on Amazon, you might want to get their credit card, which offers a 3% cashback. I don’t think that it makes sense to limit yourself to one card for the majority of your transactions because there are plenty of cashback credit cards out there, some of which are targeted towards specific purposes. This strategy works well for me because it gets the most out of the traditional purchases I make (groceries and gas) and also my more general purchases. I also own the Citi Double Cash Card, which offers an unlimited 2% cash back reward on all purchases - 1% when you make the purchase and the other 1% when it’s p[aoid off. I use that card for all of those relevant purchases. I own the American Express Blue Cash Preferred Card, which comes with 6% cashback on groceries (limited to $6000 per year), 3% cashback on gas, and 1% cashback on most everything else. I actually have a two-pronged approach as far as which credit card I use for the majority of my transactions.

“As a credit card expert, which card do you use for the majority of your transactions, and why?"ĭavid Bakke - Financial and money expert for Money Crashers

#Capital one powercard reviews series

While the last week or so has been trying to say the least for pretty much everyone, we decided to focus this edition of the roundup series on something other than what's going on from a health standpoint.Įventually, things will get better, provided people stay indoors and when they do, and when restaurants open, and we are able to go about our lives like we did a few weeks ago, all of us are going to earn tons of rewards points! In anticipation of this, Jason Steele gives us some insight as to which credit card rewards programs the credit card experts take advantage of when he asks:

0 kommentar(er)

0 kommentar(er)